ct sales tax exemptions

What is Exempt From Sales Tax In Connecticut. In Connecticut drop shipments are generally exempt from sales taxes.

Amazon Certificates Required State For Exemption Tax Refund User Guide Manuals

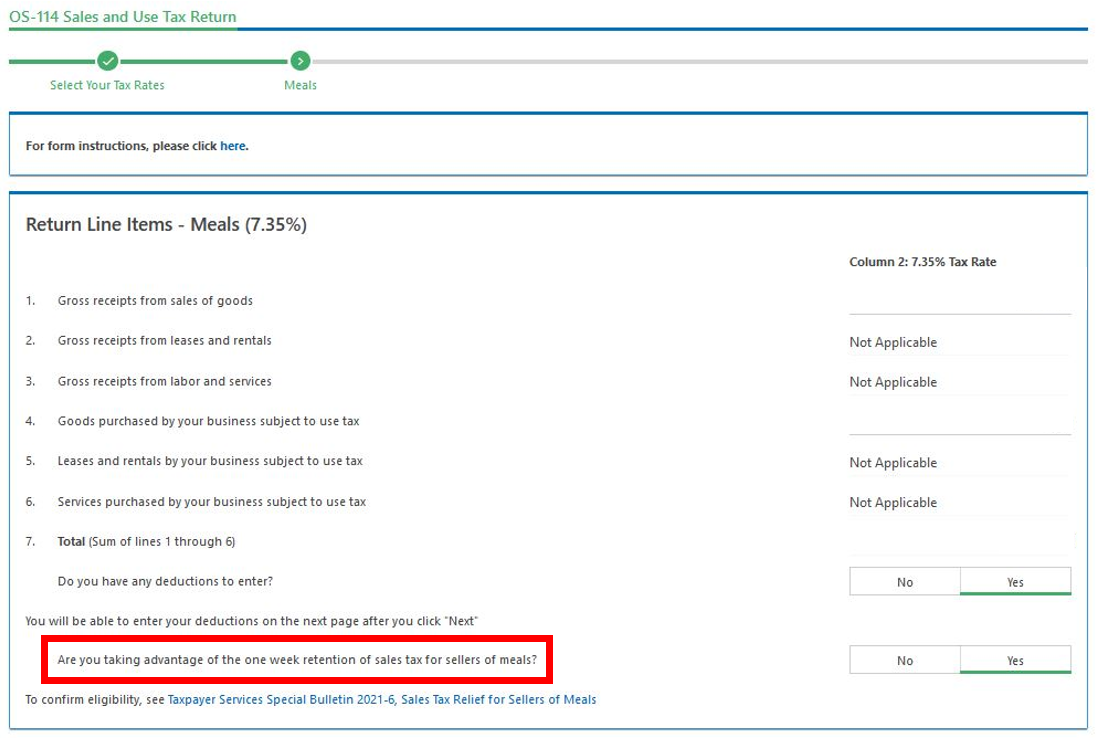

Sales tax relief for sellers of meals.

. SUMMARY This bill exempts from sales and use tax the goods and services water companies purchase to maintain operate manage or control a pond lake reservoir stream well or distributing plant or system that supplies water to at least 50 customers. The Connecticut Exempt and Taxable sales tax book for manufacturers educates on the states sales tax exemptions exclusions from tax and taxable purchases of the business starting with advertising and ending with warranty repairs. Exact tax amount may vary for different items.

Factors determining effective date thereof. Child Tax Rebate - A new child tax rebate was recently authorized by the Connecticut General Assembly. Gas Tax - For updated information on the Suspension of the Motor Fuels Tax click here.

To learn more see a full list of taxable and tax-exempt items in Connecticut. This tax exemption is authorized by Conn. Counties and cities are not allowed to collect.

This page discusses various sales tax exemptions in Connecticut. AN ACT CONCERNING A SALES AND USE TAXES EXEMPTION FOR WATER COMPANIES. Military member stationed in.

Exemption from sales tax for services rendered between parent companies and wholly-owned subsidiaries. Exemptions from Sales and Use Taxes. Groceries prescription drugs and non-prescription drugs are exempt from the Connecticut sales tax.

Renewal of Your Sales Tax Permit. Tax Treatment of COVID-19 Test Kits COVID-19 tests are generally subject to Connecticut sales and use tax. Agile Consulting Groups sales tax consultants can be found on our page summarizing Connecticut sales and use tax exemptionsIf you have questions comments or would like to discuss the specific circumstances you are encountering in regard.

45 on motor vehicles purchased by an active duty US. No local jurisdictions apply an additional sales tax therefore the state rate is fixed at 635. Sales of clothing or footwear costing less than 100 per item will not be subject to Connecticut Sales and use tax during the April 2022 Sales Tax-Free Week.

Services Subject to Sales and Use Taxes. April 2022 Connecticut Sales and Use TaxFree Week. This page describes the taxability of services in Connecticut including janitorial services and transportation services.

Sales Tax Relief for Sellers of Meals. Are drop shipments subject to sales tax in Connecticut. Manufacturing and Biotech Sales and Use Tax Exemption See if your manufacturing or biotech company is.

FilmTVDigital Media Tax Exemptions Find out more about the available tax exemptions on film video and broadcast productions in Connecticut. They need to have served during wartime at least 90 days to get the exemption. How to use sales tax exemption certificates in Connecticut.

In Connecticut certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. There are exceptions to the 635 sales and use tax rate for certain goods and services. Managing the sales tax process it is crucial to review identify and understand the states manufacturing sales tax exemptions.

The state imposes sales and use taxes on retail sales of tangible personal property and services. Investments that help your business create jobs and modernize may be eligible for tax relief including. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

Veterans in Connecticut are eligible for a 1000 property tax exemption. Sales and use tax exemption You may apply for tax relief on the purchase of tangible personal property for qualifying retention and expansion projects or projects that significantly contribute to a targeted industry cluster. 7 on certain luxury motor vehicles boats jewelry clothing and footwear.

Low-income and disabled veterans as well as their surviving spouses can get additional exemption benefits. Property Tax Exemptions for Veterans. Connecticut offers an exemption from state sales tax on the purchase of electricity natural gas and water used in qualifying production activities.

As with all Sales Use Tax research the specifics of each case need to be considered when determining taxability. 2021 Connecticut Sales Tax Free Week. Gas Tax - For updated information on the Suspension of the Motor Fuels Tax click here.

The April 2022 Sales TaxFree Week occurs Sunday April 10 2022 through Saturday April 16 2022. The Department of Revenue Services to hold Live Virtual Event about the 2022 Child Tax Rebate on July 7 2022 Click here to learn more. Sales Tax Exemptions in Connecticut.

Beginning on the July 1st 2011 the state of Connecticut levies a 635 state sales tax on the retail sale lease or rental of most goods. Applicable to certain services prior to June 30 1987. While the Connecticut sales tax of 635 applies to most transactions there are certain items that may be exempt from taxation.

Municipal governments in Connecticut are also allowed to collect a local-option sales tax that ranges from 0 to 0 across the state with an average local tax of NA for a total of 635 when combined with the state sales tax. State tax audits bring transactional errors to the attention of the boss by the state issuing tax assessments. While Connecticuts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Our Connecticut sales tax book educates and identifies manufacturers on the states sales tax exemptions and associated requirements. Digital or physical certificate will be mailed to your address. Amending a Sales and Use Tax Return.

44 rows Sales and Use Tax Exemption for Purchases Made Under the Buy Connecticut. 2022 Connecticut state sales tax. Sales tax relief for sellers of meals.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Child Tax Rebate - A new child tax rebate was recently authorized by the Connecticut General Assembly. Employees sales tax knowledge usually range from limited to skilled experiences.

By law any tangible personal property sold in Connecticut is subject to sales and use tax unless the law specifies that the property is exempt CGS 12-408. The Department of Revenue Services to hold Live Virtual Event about the 2022 Child Tax Rebate on July 7 2022 Click here to learn more. The reporting requirements for the April 2022 Sales Tax-Free Week are similar to those.

Drop shipping refers to the common business practice in which a vendor often in a different state makes a sale of a product which is shipped to the end-user by a third party supplier hired by the initial vendor. It imposes a 635 tax with some exceptions on the retail sales of tangible personal property purchased 1 in Connecticut ie sales tax or 2 outside Connecticut for use here ie use tax. Because there is no exemption applicable to COVID-19 test.

Ad Fill out a simple online application now. Exemption from sales tax for items purchased with federal food stamp coupons. Use tax is due on items purchased outside of the state and.

The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is 635. Manufacturers and industrial processors with facilities located in Connecticut may be eligible for a utility tax exemption. Connecticut has a statewide sales tax rate of 635 which has been in place since 1947.

10 Ways To Be Tax Exempt Howstuffworks

Sales Tax Exemption Consumer Healthcare Products Association

Sales Tax On Business Consulting Services

Sales Tax Relief For Sellers Of Meals

States Sales Taxes On Software Tax Software Software Sales Marketing Software

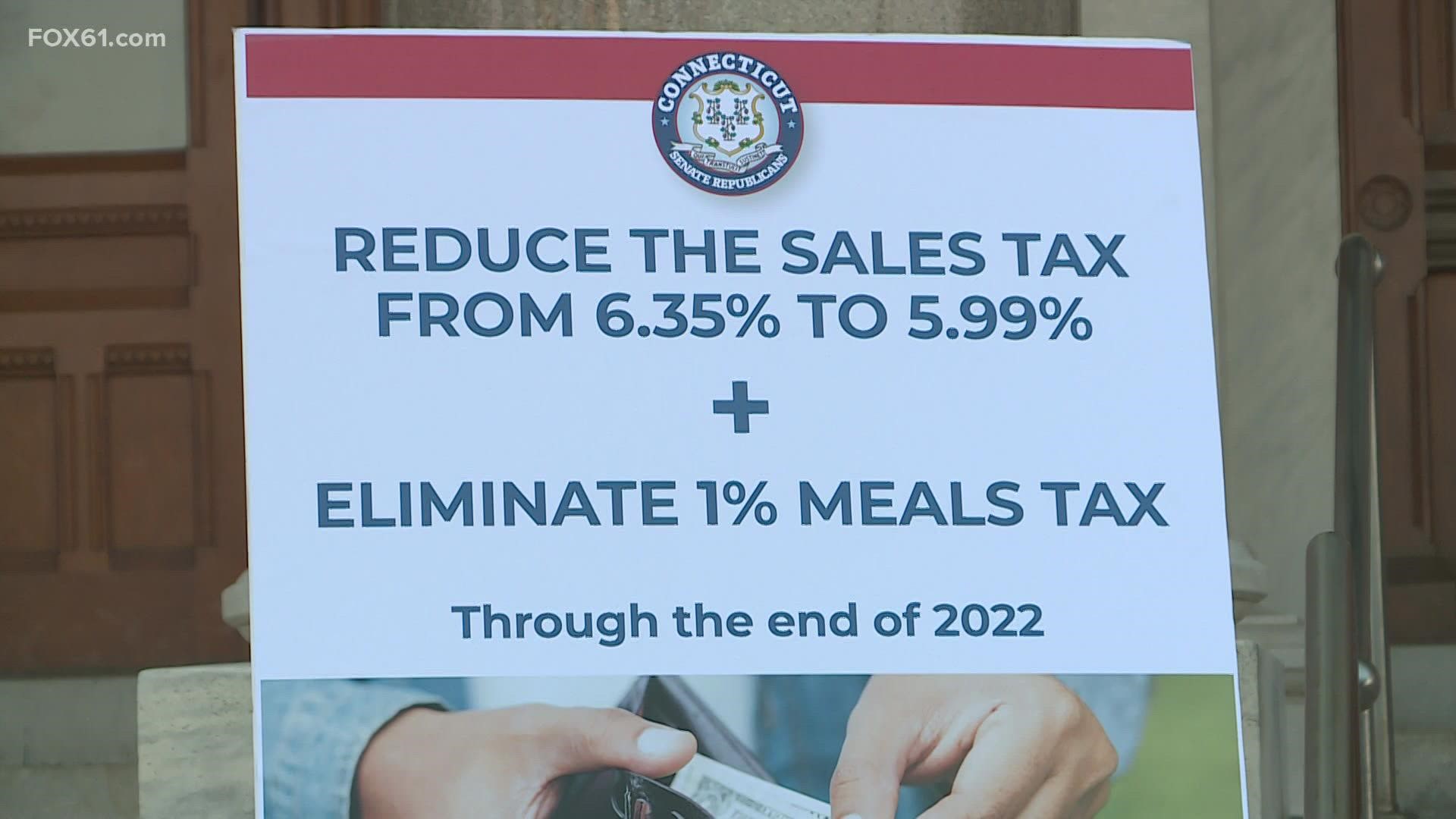

Ct State Gop Proposes Sales Tax Reduction To 5 99 Fox61 Com

Connecticut Manufacturing Sales Tax Exemption For Machinery

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Connecticut Sales Tax Handbook 2022

Sales Tax Exemptions Finance And Treasury

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

What S Exempt From Sales Tax During Connecticut S Sales Tax Free Week Nbc Connecticut

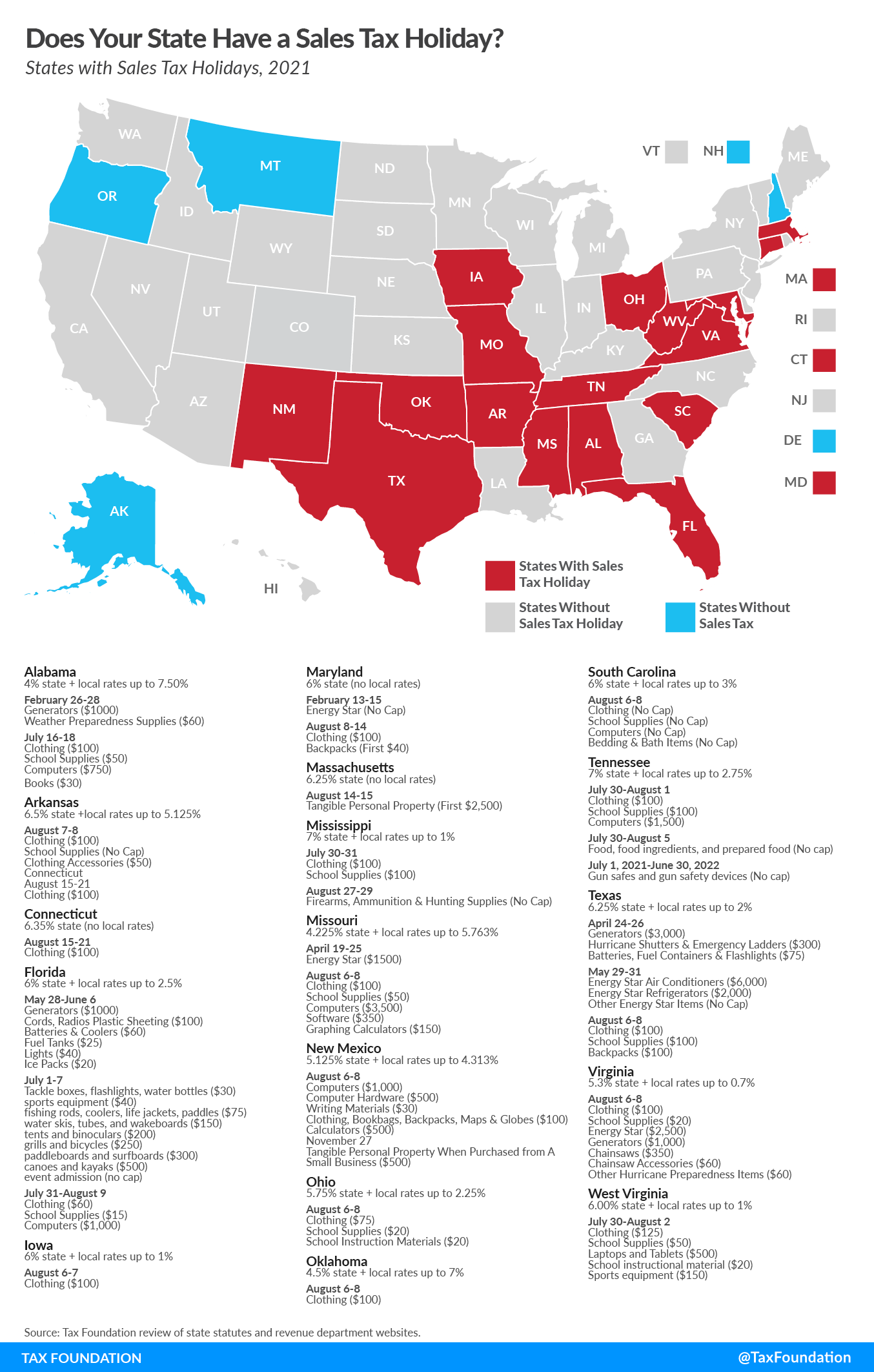

Sales Tax Holidays Politically Expedient But Poor Tax Policy